I was reading through some of the older posts in our Facebook group today and came across one of the more interesting ones I had written. I am passionate about the concept of how your mindset relates to your business, and how that can affect its trajectory.

In my opinion, people have one of two mindsets:

They settle, or they strive.

Most people will tell you they strive for more, but what does that really mean? Does it mean putting in more hours doing the same thing?

Does working harder, in and of itself, constitute striving for more?

I personally don’t believe so. I think working harder will make you more money as long as it is sustainable. However, I don’t think working harder, by itself, will make you great.

How do you become great? What is the fundamental shift in mindset that has to take place?

Being great is not only about working hard, it is about challenging yourself to find new strategies that work. It is about being creative, and deviating from common thought.

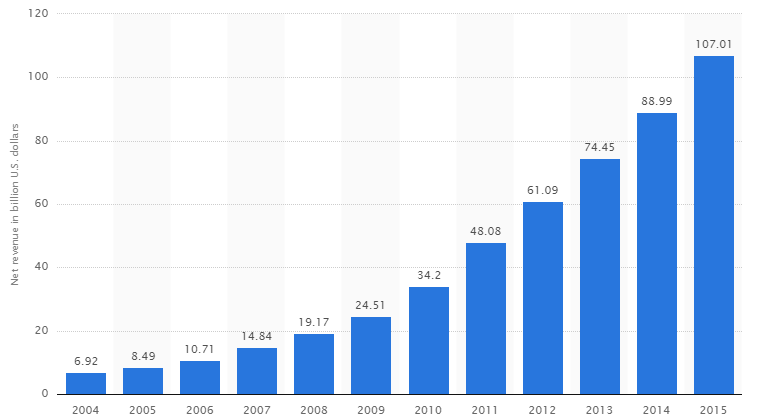

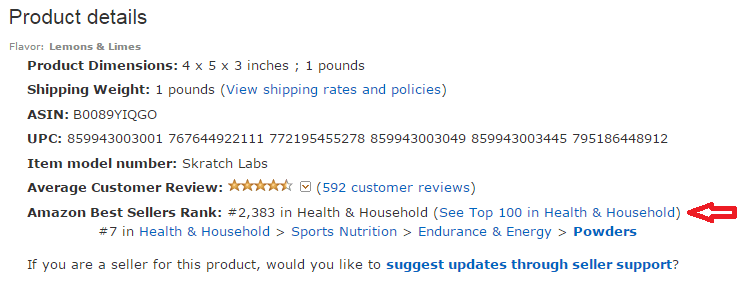

The post I referred to above was about an alarming statistic I read in reference to Amazon sellers specifically. There were more than 2 MILLION active Amazon Sellers, and only 150,000 of those sellers were doing more than $1000 per month in sales! Wow. If you extrapolate that out, you can assume only 15-40k sellers (based on the initial statistic) would be doing over $10k per month in sales. $10k is the absolute lowest amount I could imagine that could produce a full-time income (and a very low one at that).

You have to realize the dynamics involved in taking 3P Amazon Sales to the level of a business.

I can tell you what it isn’t…

- It’s not knowing everything about Amazon.

- It’s not about the sheer intelligence of the person.

- It’s not about the reasons that hold you back.

Since we started working with people on their eCommerce businesses, I have seen so many questions I had to Google or scour Amazon to find the answers to! Why is that alarming? It’s because I have been selling on Amazon for more than five years at this point, sold HUNDREDS OF THOUSANDS of products, and had never encountered (or had encountered so infrequently) the situation they were asking about.

“How is that possible,” you ask?

The real side of this is that most people look for reasons to not move forward. They look for reasons to fail, or why they might fail…

The point of this is not to suggest that you should not ask questions. It is to say, “Are you asking the right questions?”

Too many times we get ourselves in the habit of asking “How?” questions. How questions are the questions you can Google and find the answer to. More often than not, they don’t change your operation, your line of thinking, or open your eyes to possibility. If you want to raise the bar for your business, or for yourself, you need to stop thinking about “How?” questions. Just stop. Realign your mind to think in “Why?” questions. Your focus is misguided if the answer is in the procedural or rote stuff.

I want to point to two of our past students as they are PRIME examples of this. Kenny Lok and Jonathan Ramsuchit. When I met these guys, and when they took our course, their questions were difficult to answer. They weren’t procedural or related to how can I move past this task. Instead, their questions were trying to understand processes.

These guys weren’t looking for “ways to make money”, they were trying to understand the process of making money and applying it consistently. They were less caught up on the how than understanding the why! To date, these guys are super successful TWF students. While I love to believe that it was solely our great teaching that got them there, I truly believe their attitudes and mindset played a HUGE role.

In terms of operating your business, get over the mindset of learning how to complete tasks, and learn to understand the process that creates the task.

The goal of our course has never been to show people how, instead we focus on teaching people why. We don’t want to create a herd of people who blindly follow directions. Instead, we want to teach people the fundamental principles behind making a long-term viable business.

If you want to start thinking about why and move from settle thinking to thrive thinking, transition your mind to consider these simple principles.

The thing about business in general is: there is NO SUCH THING as a RISK-FREE investment. Everything and I mean EVERYTHING you buy for re-sale is an investment. Nothing is guaranteed.

You have to get over your fears, focus on learning the key points of analysis, and assess the risk of your purchase.

If you want to be successful, leave the herd mentality behind.

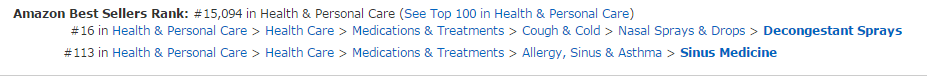

1) Sellers don’t equate to competition.

They just don’t.

The herd will tell you products are too competitive without having any factual basis for that determination. Instead, learn to analyze your competition and make decisions based on analysis rather than feeling. You will go farther, faster.

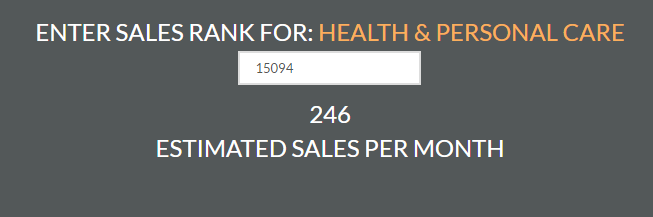

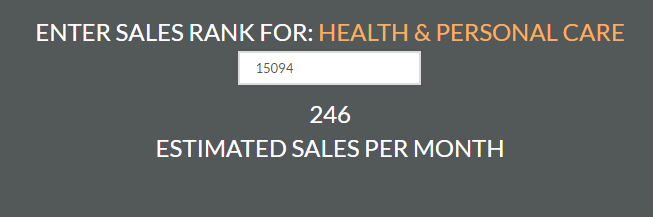

2) The herd will try to define a product by sales rank without truly understanding what sales rank is, and what that number represents.

We teach our students WHY they should analyze these. We focus on the “simple” things. If you analyze “simple” things correctly, you realize they are quite complicated. We don’t teach people to read a road map with a key, we teach them to use their compass to build their OWN map.

If you focus on the simple things and understand them at the core, you can make the jump from average to exceptional. However, that doesn’t start with HOW questions.

3) The herd says focus on margin.

This is wrong on SO many levels. First, it is the most antiquated analysis point in business. It’s truly dinosaur stuff. Also, it presumes you can control your market conditions. On a 3P direct-competition platform, you can’t control the market conditions! You end up being the guy or gal whining about the “race to the bottom.” You have to understand you can’t control what others do with their products. The sooner you realize this, the better off you will be.

Margin as a primary analysis point is only viable in a traditional retail setting, or in true manufacturing where you can control the market conditions. In the 3P market, there are too many variables to allow this.

If you want to move your mindset to the present day and make it applicable to the Amazon marketplace, think of your investments as time-based returns. If you focus from that perspective it will serve as Risk Mitigation as well as return projections over certain sets of time. This allows you to plan your investment patterns, as well as move easily from a bad investment into a good one. We focus on sell-through as opposed to maximization of return because we realize that we can’t control market factors.

The primary factors in calculating time-based return are Turn Rate and ROI. We look at profit margin still, but it is a “glance at the past” perspective. We buy based on ROI, and Turn Rate, as we believe realized margin is much more accurate than anticipated margins (even if they are higher).

Focus on Cash Flow.

When you hear others talk about this from a contrarian point of view, you should realize one of the following to be true:

- They are either an established business with very deep capital (in which case they may have the luxury to be able to wait out market fluctuation)

- They may simply be trying to maintain, and not grow (settle minded mentality).

- They are a hobby seller, and really aren’t working towards building a business.

I realize parts of this may be controversial. If they are, great! I have done my job. I have challenged you to think about your business and its direction.

Just remember, don’t be average, and don’t set your sights on average, be great!